A home renovation loan is one of the most innovative ways to upgrade your home while boosting both your lifestyle and property value. But before picking up a hammer or calling a builder, it’s crucial to understand your financing options, especially if you want to avoid overpaying interest or getting stuck with a loan that doesn’t fit your needs.

As expert mortgage brokers in Australia, Stryve Finance helps homeowners access flexible and affordable renovation finance options tailored to their goals. Let’s walk you through how to fund a renovation, your available loan types, and how we can help you do it better than the big banks.

What Is a Home Renovation Loan?

A home renovation loan is a type of financing designed to help homeowners improve, repair, or upgrade their property. Unlike general-purpose loans, renovation loans are tailored to cover expenses related to enhancing your home’s livability, value, or efficiency. Here are some top 5 Reasons Aussies Renovate Their Homes

Whether you’re making minor aesthetic improvements or significant major structural changes, the right loan ensures you can complete your project without compromising your cash flow.

These loans can be used for a wide range of projects, such as:

- Kitchen or bathroom upgrades

- Adding an extra bedroom or living space

- Outdoor improvements like decks, patios, or landscaping

- Energy-efficient updates like insulation, solar panels, or window replacements

- Repairs and maintenance including roofing, plumbing, or rewiring

At Stryve Finance, we help you choose the most suitable renovation finance option based on your goals, equity, and budget.

Types of Renovation Loans in Australia

When it comes to financing home improvements, Australians have several loan options. Each is suited to different renovation goals, property types, and financial situations. Whether planning a small cosmetic refresh or a major structural overhaul, understanding the available loan types can help you make smarter, more cost-effective decisions.

Below are the most common ways to finance your renovation project, with flexible options available through lenders and brokers.

1. Home Loan Top-Up

A home loan top-up allows you to borrow additional funds by increasing your mortgage. It’s one of the most cost-effective ways to fund home improvements because it typically comes with lower interest rates than other forms of credit. Since the loan is secured against your property, repayments can be spread across the remaining term of your mortgage.

Considerations:

- Requires sufficient home equity

- May increase your overall loan term or repayments

- May trigger new lender credit assessments or property valuation

- Possible discharge or legal fees, depending on the lender

2. Personal Loans for Renovation

Personal loans are a popular option for more minor renovations or when you don’t have enough equity in your home. They can be secured (against an asset) or unsecured, and offer fixed or variable interest rates. Many Australians use personal loans for bathroom upgrades, minor kitchen work, landscaping, or cosmetic improvements.

Considerations:

- Higher interest rates, especially unsecured

- Shorter terms = higher monthly repayments

- Maximum borrowing is typically capped at $50,000

- It may affect your credit score if not managed properly

Learn more about the pros and cons of personal loans from ASIC’s MoneySmart personal loan guide

3. Construction or Renovation Loan

A construction or renovation loan is ideal for major structural upgrades, extensions, or complete rebuilds. These loans release funds in stages, aligned with your builder’s invoicing schedule. So, you only pay interest on the amount drawn at each project stage.

Considerations:

- Requires builder contracts, quotes, council approvals

- This may involve extra paperwork and project inspections

- Progress payments must align with builder invoicing

- Requires “as-if-complete” property valuations

- You’ll need insurance (e.g., Builder’s Risk, Public Liability)

4. Redraw Facility

A redraw facility allows you to access any extra repayments you’ve made on your existing mortgage. It’s a flexible option if you’ve built surplus funds and want to use them for renovation without applying for a new loan.

Considerations:

- Only available if you’ve made extra repayments

- Limits based on how much you’ve prepaid

- Lenders may have redraw limits or fees

- Not ideal for larger projects unless surplus is significant

5. Refinancing Your Home Loan

Refinancing your home loan can unlock funds for renovation while lowering your interest rate or improving your loan features. It’s also a chance to consolidate debt or switch to a more flexible lender. This option works well when combining multiple financial goals into a single solution.

Considerations:

- Full reassessment of your financial situation

- Property revaluation required

- Break or exit fees if you’re leaving a fixed rate early

- May extend your loan term if not carefully structured

Am I Eligible for a Home Renovation Loan?

Eligibility for a home renovation loan in Australia depends on several key financial and property-related factors. Lenders assess your ability to repay the loan, the scope of your renovation, and whether you have enough equity in your home.

At Stryve Finance, we take the guesswork out of this process by evaluating your unique situation and guiding you toward lenders most likely to approve your application, often with better rates and faster turnaround than the major banks.

Credit Score Ranges vs Likelihood of Loan Approval

Here’s what most lenders typically look at:

- Stable income and employment: You’ll need to show steady income, usually through payslips, tax returns, or business financials if self-employed.

- Credit history and score: A healthy credit score increases your chances of approval and may help secure better interest rates.

- Loan-to-Value Ratio (LVR): This measures how much you’re borrowing compared to your home’s current value; a lower LVR (e.g., under 80%) usually works in your favour.

- Renovation details: Lenders often request builder quotes, plans, or contracts, especially for structural upgrades or major works.

- Available equity: If you’re topping up your home loan or refinancing, having sufficient equity in your property is essential.

- Owner-occupied vs. investment property: Financing terms may vary depending on whether the property is your home or part of your investment portfolio.

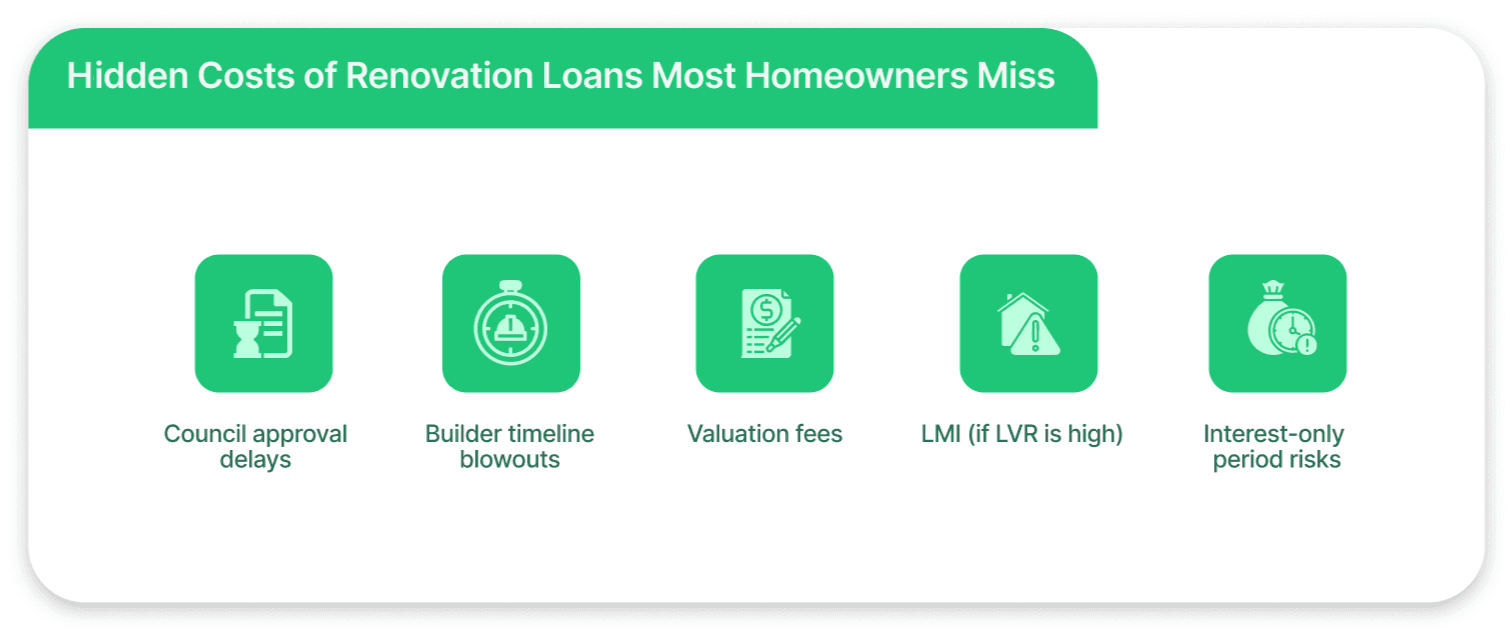

Renovation loans can be a smart way to fund home improvements, but many borrowers overlook hidden expenses that can impact their budget and timeline. Before committing to a loan, it’s important to understand the less obvious costs that can arise during the renovation process. Here's a quick overview of the most common ones to watch for:

By being aware of these hidden costs early on, you can plan smarter, avoid financial surprises, and ensure your renovation stays on track.

Not sure where you stand? Our team at Stryve Finance can assess your eligibility across multiple lenders in minutes. So you can focus on planning the perfect renovation.

How the Process Works at Stryve Finance

Financing a home renovation can feel overwhelming, especially when you’re trying to compare different lenders, loan types, and approval requirements on your own. That’s where Stryve Finance makes a difference. As an experienced mortgage broker in Australia, we guide you through the entire process, helping you avoid common pitfalls and access the most competitive renovation finance options on the market.

We act as your trusted advisor, not a salesperson for one bank. So you get transparent guidance, tailored solutions, and personal service from start to finish.

Here’s how our streamlined renovation loan process works:

Step 1: Book a Free Consultation

Tell us about your renovation goals, timeline, and current financial situation. There are no obligations, just helpful advice.

Step 2: We Assess Your Options

We calculate your borrowing capacity, check your available equity, and match you with lenders that fit your needs.

Step 3: Compare Renovation Loan Products

From top-ups and personal loans to construction loans and refinancing, we explain your options in plain English.

Step 4: Pre-Approval and Paperwork Support

We prepare your application and deal with the paperwork, so you don’t have to navigate confusing forms alone.

Step 5: Ongoing Support Until Settlement

We liaise with the lender and your builder (if needed), and keep you updated at every step, right up to loan settlement.

Step 6: Post-Loan Check-In

Once your loan is funded, we’re still here to help. We can guide you through redrawing options, rate reviews, or future upgrades.

With Stryve Finance, you get access to multiple lenders, insider insights, and peace of mind knowing that your renovation loan is set up for long-term success.

Tips to Maximise Your Renovation ROI

Renovating your home is not just about improving your living space. It’s also a strategic opportunity to boost your property’s value. However, not all upgrades deliver the same return on investment (ROI). To ensure your renovation dollars work harder, planning with the market in mind, avoiding emotional overspending, and prioritising areas that buyers and valuers see as most impactful.

Here are smart, value-focused renovation tips to get the best return on your investment:

- Focus on kitchens and bathrooms: These are the most scrutinised rooms during property valuations and inspections. A modern, functional kitchen or an upgraded bathroom can significantly increase resale value.

- Don’t overcapitalise: Keep your renovation budget in proportion to the overall value of your home and local property prices. Overspending can make it hard to recover costs if you sell.

- Invest in energy-efficient upgrades: Solar panels, insulation, LED lighting, and double-glazed windows can reduce long-term utility costs and appeal to eco-conscious buyers.

- Improve outdoor living areas: Decks, patios, and landscaping upgrades enhance lifestyle appeal, especially in the Australian market where outdoor entertaining is a big draw.

- Use licensed and insured professionals: Quality craftsmanship ensures your renovations meet building codes, avoid costly rework, and stand the test of time.

- Document everything: Keep receipts, contracts, before/after photos, and council approvals. These can support higher property valuations and help during resale or refinancing.

With the right approach, your renovation can pay dividends not just in lifestyle, but in long-term financial growth. At Stryve Finance, we help you align your renovation finance with your goals and budget, so you renovate with clarity and value. Check your eligibility for government energy efficiency rebates and loans.

Why Choose Stryve Finance Over the Big Banks?

While big banks offer limited loan options and generic advice, we compare renovation finance solutions from a wide panel of lenders to find the best fit for your unique needs.

How Broker Beat Banks

With personalised service, faster turnaround times, and expert guidance every step of the way, we make it easier to renovate with confidence and save you money in the process.

| Feature | Stryve Finance | Big Bank |

|---|---|---|

| Access to Multiple Lenders | Yes | Limited to own products |

| Personalised Advice | Mortgage Expert | Call Centre Scripts |

| Fast Pre-Approvals | Often 48 Hours | 1–2 weeks+ |

| Broker Loyalty | Works for You | Works for Shareholders |

| Flexible Loan Structures | Yes | Often Rigid Terms |

Case Studies

At Stryve Finance, we’ve helped homeowners across Australia transform their spaces through smart renovation finance. Whether it’s a growing family needing more room or an investor upgrading a rental property to boost returns, our tailored loan strategies have made it possible. Here are a few examples of how we’ve helped clients achieve their goals with the right renovation loan solution:

- Emily and James – Brisbane: Used a $75,000 home loan top-up to renovate their kitchen and bathrooms. With Stryve’s guidance, they retained their low interest rate and avoided refinance fees. Their home valuation increased by $130,000 post-renovation.

- Raj – Melbourne: Took out a $40,000 personal loan for landscaping and energy-efficient upgrades before selling his property. The improvements attracted 3 competing offers and added curb appeal in a tight market.

- Tina – Sydney’s Inner West: Worked with Stryve to secure a construction loan for a second-storey extension. We helped coordinate the builder quote, staged drawdowns, and lender approval. Tina’s loan was approved in under 7 days.

These stories are just a glimpse into what’s possible when you have access to the right loan structure and expert advice. At Stryve Finance, we don’t just process applications, we build strategies for real renovation success.

FAQs: Renovation Loan

Q: Can I get a home renovation loan with no equity?

A: Yes, with a personal loan or unsecured renovation loan, though rates may be higher.

Q: How much can I borrow?

A: It depends on your income, credit score, and equity. We help you determine this in minutes.

Q: How long does it take to get approved?

A: With Stryve Finance, many loans are pre-approved within 24–48 hours.

Q: Can I use a renovation loan for investment property upgrades?

A: Absolutely, just be sure to let us know your plan for occupancy, as it affects loan options.

Q: Can I get a renovation loan before I buy a property?

A: Yes, some lenders offer loan packages that include both purchase and renovation costs. This is especially useful if you're buying a fixer-upper and want to start work immediately after settlement. We can guide you through pre-approval options.

Q: What documents do I need for a renovation loan?

A: Typically, lenders require:

- Proof of income (payslips, tax returns)

- ID and credit report

- Property valuation

- Detailed renovation plans or quotes from licensed builders

Q: Is it better to use a redraw facility or apply for a new loan?

A: It depends on your situation. A redraw facility is ideal if you’ve made extra repayments and want fast access to funds without new paperwork. However, a new loan or top-up may be better for large or complex renovations. We’ll compare both for you.

Q: Can I use a renovation loan to add value before selling?

A: Absolutely. Strategic renovations, like updating kitchens, improving curb appeal, or adding a bedroom, can significantly boost resale value. A short-term loan could be a smart investment if timed well.

Let’s Renovate the Right Way

At Stryve Finance, your home should evolve with your lifestyle. Whether creating space for a growing family or boosting resale value, we help you get there with the right loan at the best rate without the stress.

👉 Book a Free Renovation Loan Consultation Today

Dylan Bertovic is the Director and Senior Finance Broker at Stryve Finance, specialising in non-traditional lending solutions. He helps clients across Australia with tiny home loans, construction finance, equipment and asset lending, refinancing, and investor loans. With deep expertise in self-employed and renovation mortgages, Dylan is known for crafting tailored strategies that get results