Navigating the home loan landscape can be challenging, especially for self-employed individuals in Australia. According to the Australian Bureau of Statistics, approximately 15% of the Australian workforce is self-employed (ABS Labour Force Survey, 2020). Despite their growing numbers, self-employed borrowers face additional hurdles when applying for a home loan, particularly because lenders view their income as more variable than that of salaried employees.

Lenders require specific documents required for self-employed home loans to assess income stability, business viability, and overall financial health. One of the key factors in securing a loan is presenting the right documentation. Without proper documentation, even the most promising self-employed applicants could face delays or rejection.

This article will guide you through the necessary documents required for a self-employed home loan in Australia, explain the additional steps needed, and provide tips on preparing your application to improve your chances of approval.

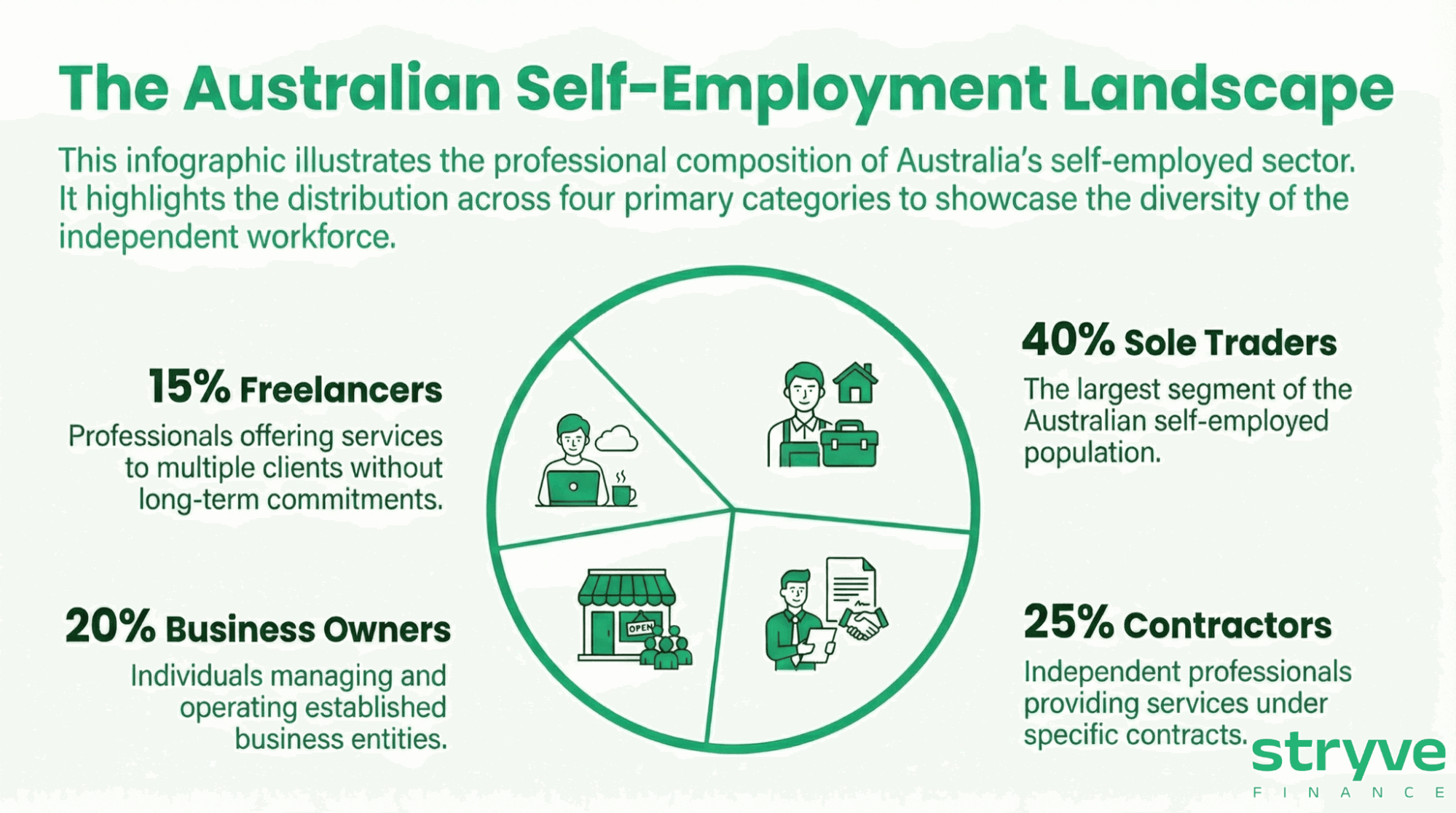

Who Is Considered Self-Employed in Australia?

In Australia, self-employed individuals are typically classified as sole traders, contractors, business owners, or even partners in a business. If you operate your own business, work on a contract basis, or generate income through freelance work, you fall under the self-employed category. Here's a breakdown of who qualifies:

- Sole Traders: Individuals who own and run their own business, including tradespeople, consultants, and freelancers.

- Contractors: Professionals working on a contractual basis (e.g., IT consultants, construction workers).

- Business Owners: Individuals who own and manage a company, partnership, or trust.

- Freelancers: Individuals who offer their services to clients without being tied to a single employer.

If you're self-employed, lenders will assess your financial stability based on your business income, tax filings, and other supporting documents.

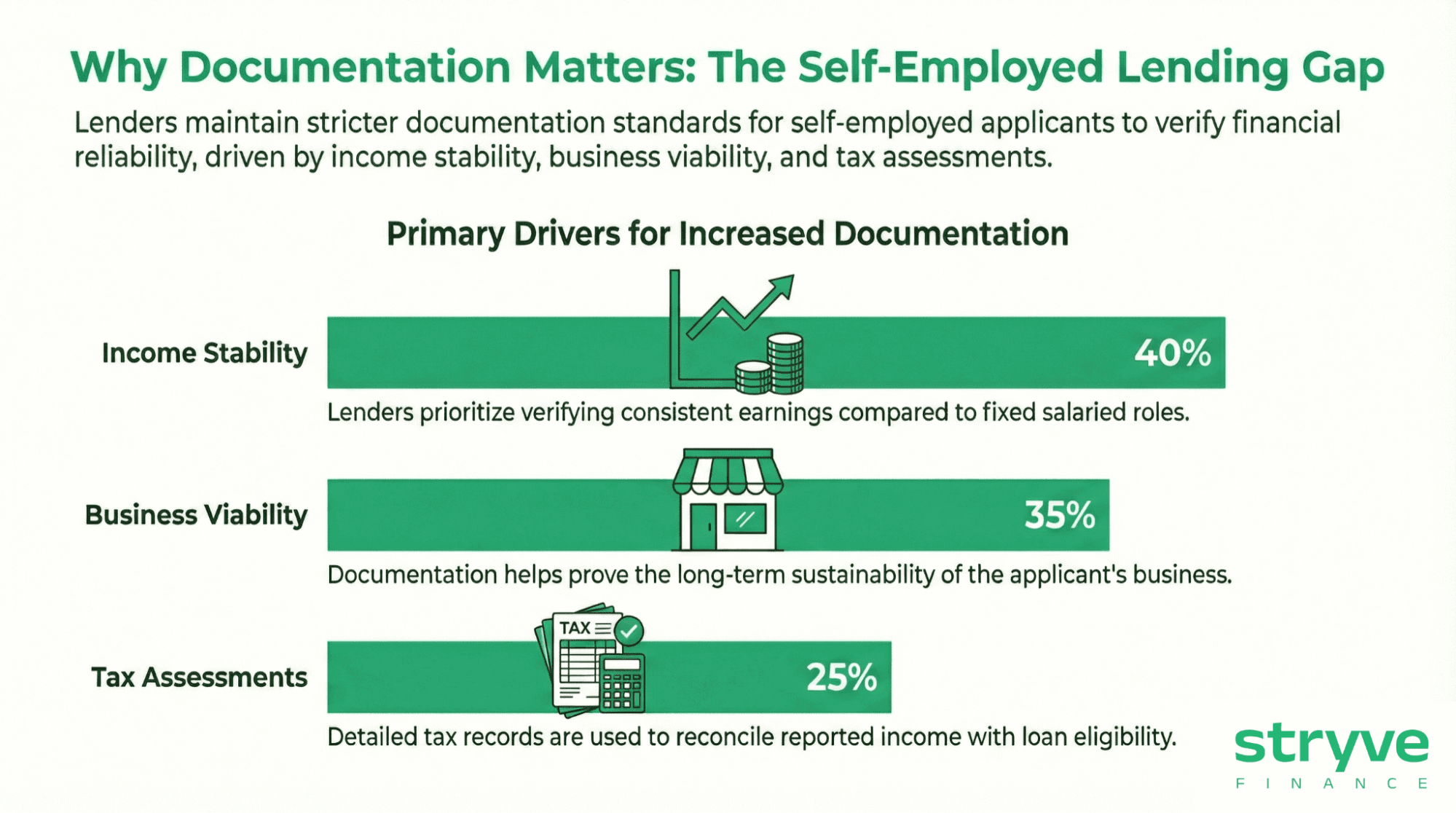

Why Are Documents More Important for Self-Employed Applicants?

For self-employed individuals, lenders face greater risk when approving home loans because income is more volatile. In fact, around 30% of self-employed businesses fail within the first five years of operation, which increases the perceived risk for lenders (ABS Business Failures, 2019). As a result, lenders require more thorough documentation to assess the consistency and reliability of earnings. Here's why:

- Income Stability: Lenders need to ensure that your income is stable enough to handle monthly mortgage payments. Unlike salaried employees with regular paychecks, self-employed income can be inconsistent, especially during lean business periods.

- Business Viability: Lenders want to verify that your business is profitable and likely to continue generating revenue.

- Tax Assessments: By reviewing your tax returns, lenders can gain a clear understanding of your earnings and any potential liabilities or deductions.

Thus, the documentation required of self-employed applicants is crucial for lenders to assess the long-term reliability of your income.

Key Documents Required for Self-Employed Home Loans

When applying for a self-employed home loan, lenders will request a variety of documents to ensure that you can meet your financial obligations. Since self-employed income can fluctuate, the documents required for a self-employed home loan are essential to prove stability. Data from the Mortgage & Finance Association of Australia (MFAA) shows that over 60% of lenders consider tax returns and business financials as the most important documentation when reviewing a self-employed home loan application

Here's a breakdown of the key documents you will need to provide:

1. Tax Returns (Last 2 Years)

Your personal tax returns from the last two years are one of the most important documents required for your home loan application. Lenders use these to assess your income, as they provide an official record of what you've earned over time. You will also need to provide your ATO Notice of Assessment, which serves as official confirmation of your declared income.

2. Financial Statements

If you operate a business, you'll need to provide detailed financial statements for your business. These include:

- Profit and Loss Statements: These documents show your business's income and expenses over a set period, typically monthly or annually.

- Balance Sheets: A balance sheet outlines your business's financial position, including assets, liabilities, and equity.

- Business Tax Returns: For business owners, partners, or trust beneficiaries, returns from the past two years are crucial for verifying income and confirming your business is operating profitably.

At Stryve Finance, we ensure all financial documents are presented accurately, whether you're a sole trader, a contractor, or running a larger business structure.

3. Bank Statements (Last 3-6 Months)

Lenders will often request bank statements for the last 3 to 6 months to assess your cash flow and financial behaviour. These statements help lenders confirm that your reported income matches your actual deposits. Bank statements also provide insight into how you manage your finances, including any irregularities in income or excessive spending.

4. Income Verification

In addition to tax returns and financial statements, you may need to provide supplementary income verification documents. These could include:

- Invoices and Contracts: If you're a contractor or freelancer, providing recent contracts or invoices will help lenders verify your income.

- Payslips (for contractors): If you have paid contracts or regular clients, providing payslips or proof of payment can serve as additional evidence of income stability.

The more comprehensive and accurate your income verification documents are, the better your chances of a smooth approval process.

5. Self-Employed Business Documents

For business owners, lenders require proof that your business is operational and profitable. These documents may include:

- Business Registration: Proof that your business is legally registered and compliant with Australian regulations.

- Client Contracts and Agreements: Contracts that demonstrate your ongoing business relationships or expected future income.

- Business Insurance: Proof of insurance may be required, especially for high-risk industries.

6. Additional Documents for Partnerships/Companies/Trusts

If your business operates as a partnership, company, or trust, lenders may ask for additional documentation, such as:

- Partnership Agreements: For partnerships, providing details on the business structure and how responsibilities are divided is essential.

- Company Financials: For corporations, lenders typically require full financial statements, including income statements and balance sheets.

- Trust Deeds: If you're operating under a trust, you'll need to provide the trust deed along with any details about income distribution.

By ensuring you have all these documents ready and organised, you'll be in a stronger position when it comes time to apply for your self-employed home loan. Check our article all about self employed home loans for more details

Documents for Low-Doc Loans

For self-employed individuals who may not have traditional documentation (such as full tax returns), low-doc loans are an option. These loans are designed for people with limited financial documentation, but they still require some form of verification.

Typical documentation for low-doc loans includes:

- BAS (Business Activity Statements): Provides evidence of business turnover and GST activity.

- Accountants' Declarations: A letter from your accountant that attests to your income and business performance.

- Bank Statements: Lenders will still require at least 3 to 6 months of personal or business bank statements to verify income flow.

While low-doc loans can be helpful for some self-employed individuals, they often come with higher interest rates and stricter terms.

Additional Tips for Self-Employed Applicants

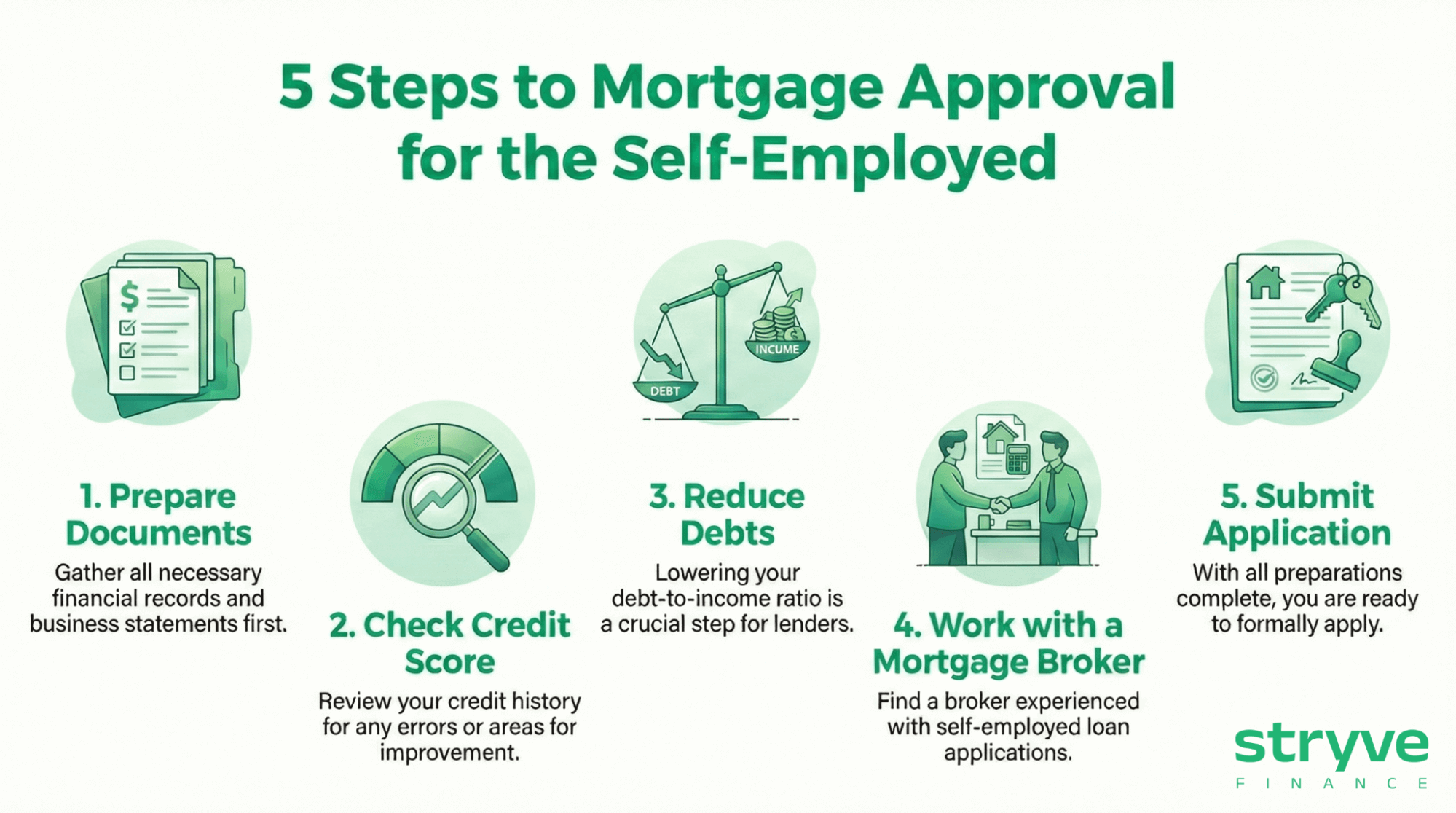

Securing a self-employed home loan can be more challenging than for salaried employees, but with the right preparation and a clear strategy, you can improve your chances of approval. Here are some additional tips to help self-employed individuals stand out in the mortgage application process:

1. Maintain a Good Credit Score

One of the most critical factors lenders consider is your credit score. A strong credit score demonstrates that you're responsible with managing debt and paying bills on time. Even for self-employed applicants, a solid credit history can significantly improve approval odds.

To boost your credit score, ensure that you're paying off existing loans and credit cards regularly, keeping your credit utilisation low, and avoiding late payments.

At Stryve Finance, we can provide guidance on improving your credit score and ensure you're in the best possible position before applying for your mortgage.

2. Reduce Existing Debts

If you have outstanding debts, consider paying them off before applying for a loan. This can improve your debt-to-income ratio, which is an important factor for lenders.

A lower debt load shows lenders that you're financially stable and capable of managing additional debt, such as a home loan.

3. Save a Larger Deposit

A larger deposit can help you secure a loan even if your documentation isn't perfect. By making a larger deposit (typically 20% or more), you reduce the lender's risk, increasing the likelihood of approval.

Having a larger deposit can also help you avoid paying lender's mortgage insurance (LMI), which is an added cost if your deposit is below 20%.

4. Be Prepared to Explain Business Risks

Lenders may want to understand any potential risks associated with your business. This could include industry changes, competition, or the impact of economic downturns. Be prepared to explain how you're managing these risks and why your business remains stable despite them.

If your business is relatively new, you may need to provide a detailed business plan outlining projected revenue, growth strategies, and market conditions.

5. Work with a Mortgage Broker

Navigating the home loan process can be daunting, especially for self-employed individuals. A mortgage broker, like Stryve Finance, can be invaluable in helping you secure the best loan options available. We have access to 50+ lenders and can help you find the most competitive rates and terms.

A mortgage broker will also assist in organising your documents, ensuring everything is in order before submitting your application. With our expertise and guidance, you can save time and avoid common pitfalls in the application process.

Conclusion

Securing a home loan as a self-employed individual in Australia may seem like a challenging task, but with the right preparation and the necessary documentation, you can successfully navigate the process. By understanding the documents required for a self-employed home loan, organising your finances, and working with a trusted expert like Stryve Finance, you'll be well-equipped to present a strong application that increases your chances of approval.

At Stryve Finance, we specialise in helping self-employed individuals access the best home loan options available. Whether you're a sole trader, contractor, or business owner, we understand the unique challenges you face and can guide you every step of the way. From gathering the right paperwork to finding the perfect loan for your situation, our team is here to support you.

Contact us now for a free consultation, and let's work together to find the best home loan solution for your self-employed business. Your dream home is closer than you think!

Frequently Asked Questions (FAQs)

1. What if I don't have two years of tax returns?

If you're a new business owner and don't have two years of tax returns, some lenders may consider other documents, such as a detailed business plan or a year-to-date profit and loss statement. Low-doc loans may also be an option.

2. Can I apply for a mortgage if my business is less than a year old?

Yes, you can, but it may be more challenging. Lenders will require strong evidence of business performance, such as contracts, bank statements, and an accountant's declaration.

3. How long does it take to get approved for a self-employed home loan?

The approval process for self-employed individuals may take longer than for salaried applicants due to additional documentation requirements. On average, it may take 4 to 6 weeks, but this can vary by lender and the complexity of your financial situation.